Overview

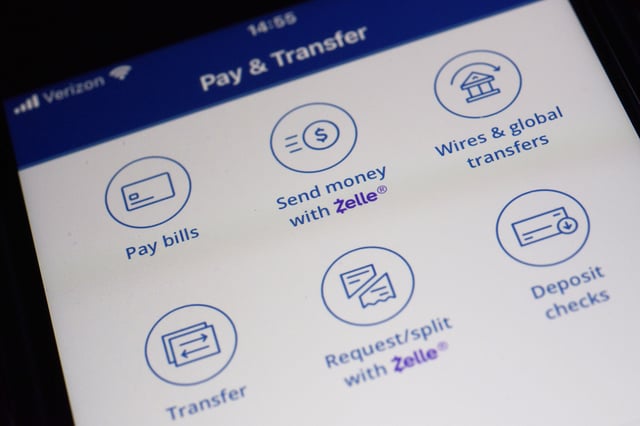

- Letitia James filed a state-court lawsuit on August 13 alleging Early Warning Services designed Zelle with rapid onboarding and weak safeguards that left users exposed to scams.

- The complaint cites irreversible instant transfers and delayed verification as key flaws that enabled account takeovers, utility impersonations and fake-purchase schemes between 2017 and 2023.

- New York’s action follows the CFPB’s March dismissal with prejudice of a federal suit and aims to fill the enforcement gap by demanding consumer remedies and network reforms.

- EWS, owned by seven major banks including JPMorgan Chase and Bank of America, is accused of resisting basic safeguards until 2023 but denies wrongdoing and calls the lawsuit a political stunt.

- The case is now pending in New York state court as the attorney general pursues systemic changes at Zelle and restitution for defrauded consumers.