Overview

- Mailings began Sept. 26 and will continue in staggered batches through October and November, with timing not based on ZIP code.

- Eligibility is determined from 2023 resident income tax filings (Form IT-201), with no application required and dependents excluded.

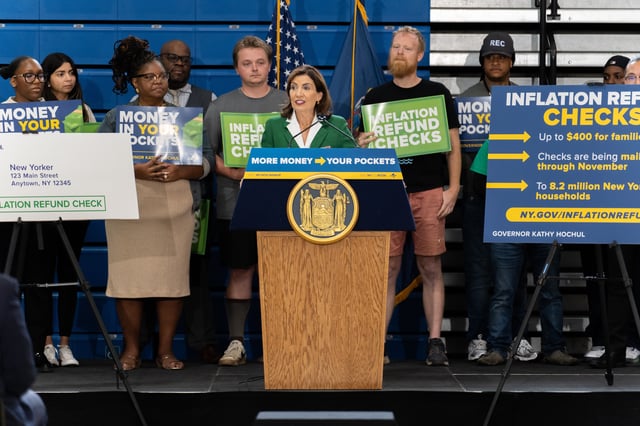

- Amounts are $400 for joint filers up to $150,000, $300 for joint filers $150,000–$300,000, $200 for single filers up to $75,000, and $150 for single filers $75,000–$150,000.

- Payments are being issued as paper checks rather than direct deposits, administered by the New York State Department of Taxation and Finance.

- State officials peg the program’s cost at about $2 billion, with 3.53 million recipients in New York City and 1.25 million on Long Island, as critics question the one-time relief approach.