Overview

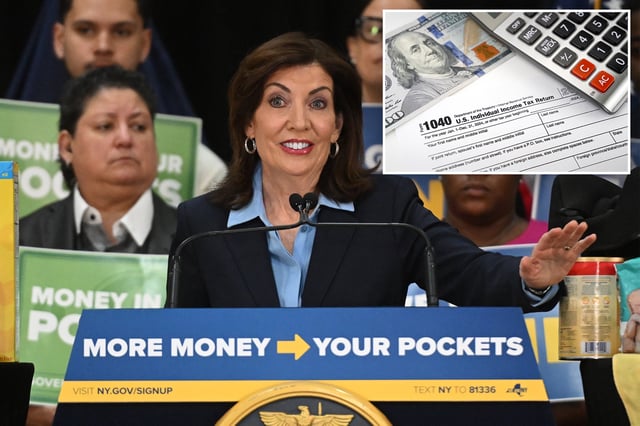

- The budget provides one-time inflation refund checks of $150 to $400 for approximately 8.2 million tax filers, based on 2023 income thresholds.

- Eligible residents will automatically receive the checks in the fall, with no need to apply, as the state uses data from 2023 tax returns.

- Middle-class tax cuts, the largest in nearly 70 years, will reduce rates for lower- and middle-income earners, totaling $1 billion in relief.

- The plan doubles the Child Tax Credit for income-eligible families, offering up to $1,000 per child under age 4 and $500 per child ages 4–16.

- Universal free breakfast and lunch for all K-12 students, regardless of income, is expected to save families an average of $1,600 per child annually.