Overview

- Mailings began Sept. 26 and will continue in batches through October and November, with paper checks arriving on varying timelines not tied to zip codes.

- Eligibility is based on 2023 filings of Form IT-201 and not being claimed as a dependent, and no application is required.

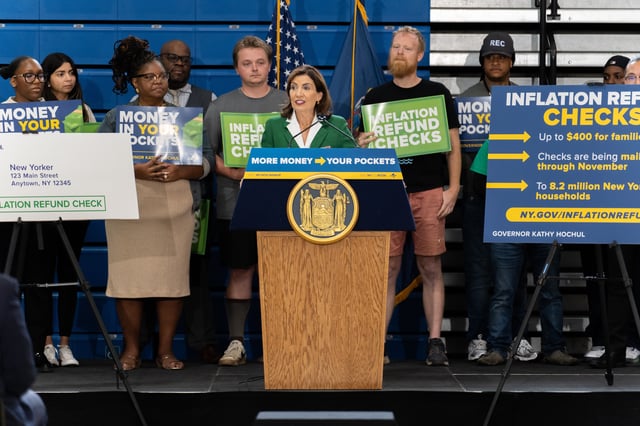

- Amounts are tiered: $400 for joint filers up to $150,000, $300 for joint filers $150,000–$300,000, $200 for single filers up to $75,000, and $150 for single filers $75,000–$150,000.

- The program totals roughly $2 billion and was included in the budget signed in May, with about 3.53 million recipients in New York City and 1.25 million on Long Island out of 8.2 million statewide.

- Recipients who have moved should update their address with the Tax Department, and the effort has drawn criticism from some Democrats and fiscal analysts concerned about projected deficits and recent federal funding cuts.