Overview

- Nasdaq has begun telling listed companies that certain plans to sell stock to fund cryptocurrency purchases must go to a shareholder vote, with noncompliant issuers facing potential trading suspensions or delisting.

- The new oversight lands on a crowded pipeline of corporate crypto treasuries, with more than 100 U.S.-listed firms planning roughly $130 billion in token acquisitions, a majority on Nasdaq.

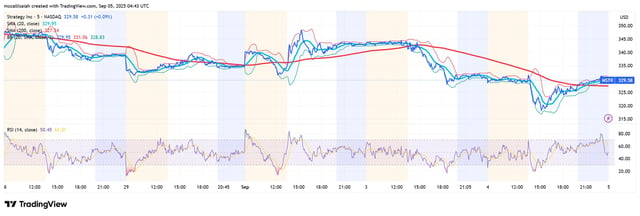

- Crypto-linked equities sold off on the news as names such as Nakamoto Holdings, American Bitcoin, BitMine Immersion, and SharpLink dropped sharply, while larger players like Strategy fell more modestly.

- Major tokens slipped alongside the equities move, with Bitcoin dipping below $110,000 intraday as Ether and Solana also declined.

- Nasdaq’s review complements Rule 5635, which already requires shareholder approval in several financing scenarios, and is expected to slow deal cadence by routing many raises through proxy processes.