Overview

- Catamaran Ventures president Deepak Padaki said middling startups are trading at 30–40% discounts as funds near the end of their terms and rush to sell.

- The family office plans to deploy patient capital into manufacturing supply chains, targeting aerospace, electric vehicles, electronics and possibly medical devices.

- Deals that offer only minority stakes without strategic influence are no longer attractive to the firm.

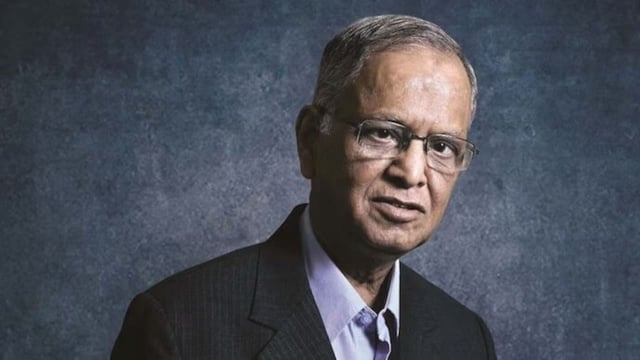

- Deployment has slowed, with only two new investments since early 2024, and the firm manages roughly $1.3 billion for Narayana Murthy.

- The recalibration comes as India’s venture market cools from a $38.5 billion peak in 2021 to about $13.7 billion in 2024, and Catamaran’s holdings include SpaceX and the National Stock Exchange of India.