Overview

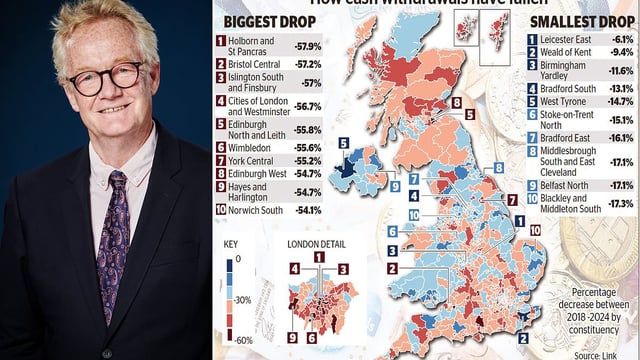

- Cash usage in the UK has dropped from 51% of transactions in 2013 to just 12% by 2023, with ATM withdrawals falling 31% since 2019.

- The Treasury Committee warns that declining cash acceptance risks excluding vulnerable groups, such as the elderly and those without bank accounts, from essential services.

- MPs recommend legal mandates requiring businesses to accept cash if safeguards for cash users prove insufficient in the future.

- The committee highlights gaps in cash acceptance at locations like car parks and leisure centres, urging HM Treasury to monitor and report on cash accessibility annually.

- The government, however, has stated it has no plans to compel businesses to accept cash, emphasizing efforts to expand banking hubs and address digital exclusion.