Overview

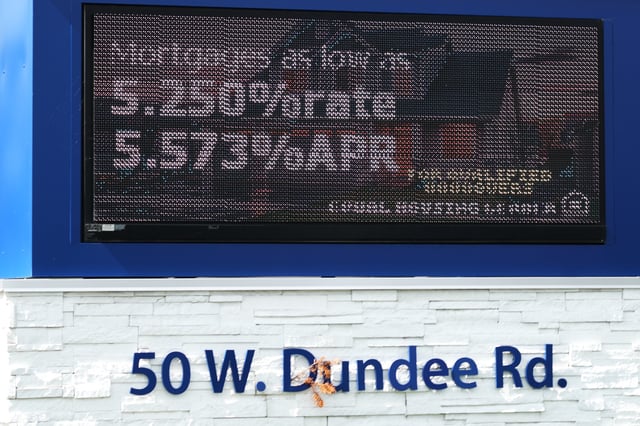

- Freddie Mac’s latest survey shows the average 30-year fixed mortgage at 6.30% for the week of Sept. 25, up from 6.26% a week earlier, with the 15-year rising to 5.49%.

- Even with the slight rise, activity has firmed: Freddie Mac reports purchase applications up 18% year over year and refinances up 42%, and MBA data show refinancing up sharply over the past month.

- Some trackers earlier in the week showed averages in the low‑6% range; at roughly 6.13%, estimated monthly principal-and-interest payments are about $1,520 on a $250,000 loan and $2,432 on a $400,000 loan, according to CBS calculations.

- Economists note mortgage markets are forward-looking; the 10-year Treasury yield moved to about 4.19%, helping nudge mortgage rates higher, and upcoming labor and inflation data will guide the next moves.

- Realtor.com finds metros with more mortgaged owners—such as Washington, D.C., Denver, Virginia Beach and Raleigh—are poised to see a bigger response to lower rates than places with many outright owners like Miami, Buffalo and Pittsburgh.