Overview

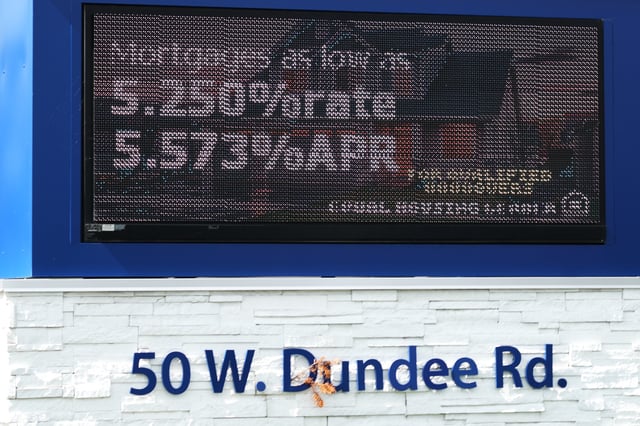

- Freddie Mac reports the 30-year fixed average at 6.30% for the week ending Sept. 25, up from 6.26% after a four-week decline, with the 15-year at 5.49%.

- The Federal Reserve lowered its benchmark rate by 25 basis points last week, yet mortgage pricing continues to track the 10-year Treasury and forward-looking expectations rather than moving one-for-one with Fed actions.

- Refinancing momentum has strengthened, with the MBA showing the refi index up 80% from four weeks earlier and applications up 1% week over week, while Freddie Mac cites purchase and refinance applications up 18% and 42% year over year.

- Recent rate levels are delivering tangible savings for borrowers, such as about $150 per month on a $250,000 loan and roughly $240 per month on a $400,000 loan versus January’s 7.04% average.

- Realtor.com expects metros with a high share of mortgaged households—Washington, D.C., Denver, Virginia Beach and Raleigh—to respond more strongly than markets with many outright owners such as Miami, Buffalo and Pittsburgh.