Overview

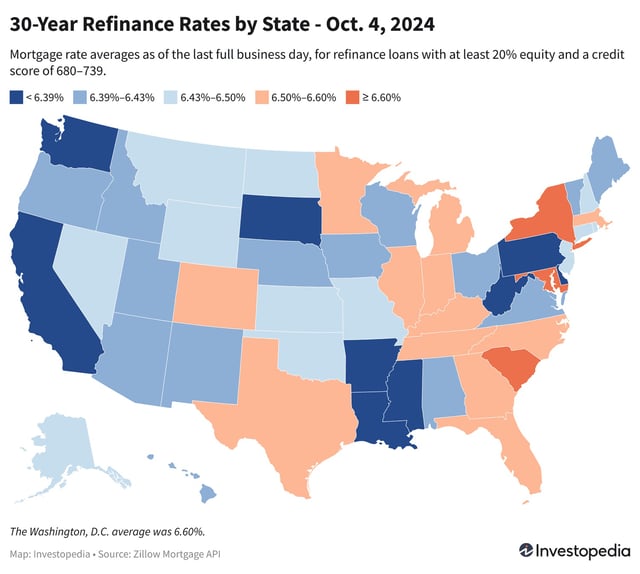

- National average for 30-year fixed mortgages is 6.32%, with rates in states like California and Florida among the lowest.

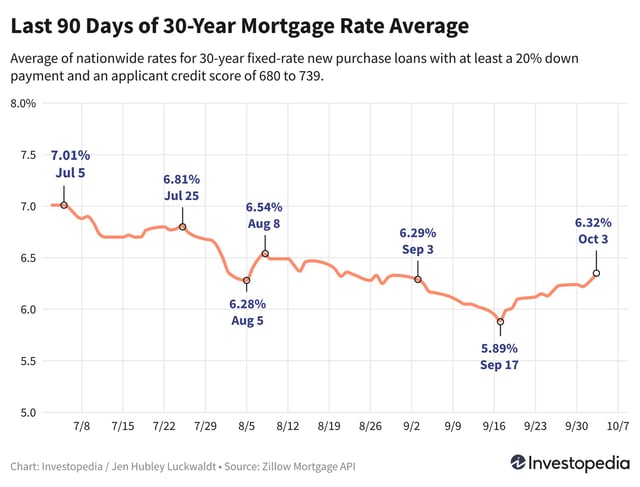

- Refinance rates for 30-year mortgages have reached 6.44%, marking a two-week high after recent fluctuations.

- Upcoming employment data could influence the Federal Reserve's next interest rate decision, with a potential impact on mortgage rates.

- Current economic conditions, including inflation and labor market trends, play a significant role in determining mortgage rates.

- The Federal Reserve's recent rate cut is expected to be the first in a series, potentially affecting future mortgage rate trends.