Overview

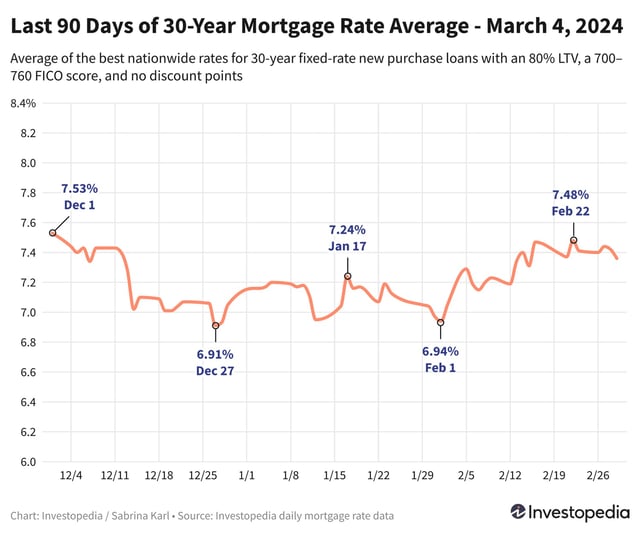

- Mortgage rates remain steady with 30-year fixed-rate mortgages holding at 6.875% as of March 4, 2024.

- Experts predict mortgage rates may decrease later in 2024, influenced by Federal Reserve rate cuts and declining inflation.

- The Federal Reserve's future rate decisions are anticipated to impact mortgage rates, with potential rate cuts expected as early as June.

- Comparing lenders and loan offers is crucial for borrowers to secure the best mortgage rates and terms.

- Mortgage rates are not directly tied to the federal funds rate, but investor expectations regarding the economy can influence them.