Overview

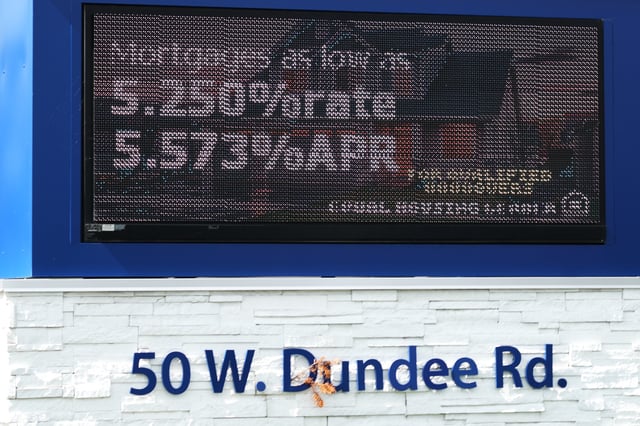

- Freddie Mac’s 30‑year average rose to 6.30% from 6.26% last week, with the 15‑year fixed up to 5.49%.

- Refinance activity has jumped, with the MBA Refinance Index at 1,597 for the week of Sept. 12, the highest September reading in years.

- The surge has limits because a large share of borrowers already hold sub‑5% mortgages, according to FHFA data showing 71.3% below 5.0%.

- Rates track moves in the 10‑year Treasury and elevated mortgage‑backed security spreads, which remain wide given sticky inflation and reduced Fed MBS demand.

- Realtor.com expects metros with many mortgaged owners—such as Washington, D.C., Denver, Virginia Beach and Raleigh—to see the biggest response, while forecasts from major groups point to mid‑6% rates through late 2025 with modest easing possible into 2026.

![renee.jones@startribune.com 'For sale' signs were posted outside two neighboring Minneapolis homes Tuesday afternoon. ]](/cdn-cgi/image/onerror=redirect,width=640,height=640,format=webp/https://storage.googleapis.com/uploads.mongoosehq.com/url/media/52622720/e783b46ddcabd4eee4082252fe6f0cad22e5c30de8717b9a7713e4c828b8b3f4)