Overview

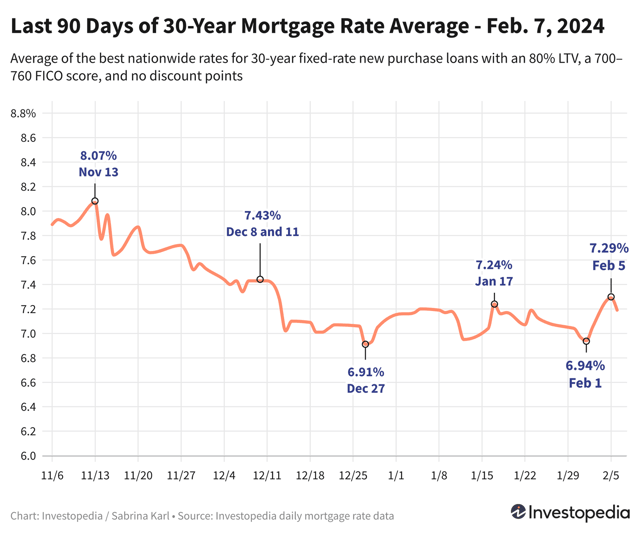

- Mortgage rates have decreased slightly over the past week, with the 30-year fixed rate at 6.60% and the 15-year fixed rate at 5.76%.

- High inflation and central bank policies, including the Fed's, are expected to drive mortgage rates up in the near term.

- Geopolitical tensions and the strong job market add to the economic uncertainty, influencing mortgage rate trends.

- Analysts advise shopping around for mortgage rates and improving financial profiles to secure the best deals amid rising rates.

- Investor expectations of Federal Reserve policy changes are a key factor in mortgage rate fluctuations, with potential rate cuts anticipated by mid-year.