Overview

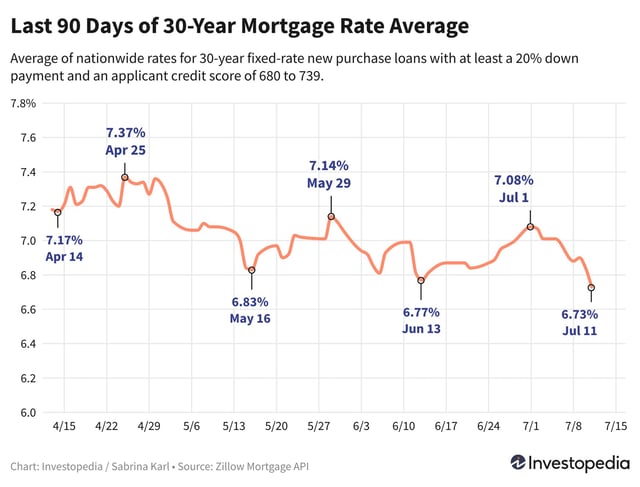

- 30-year fixed mortgage rates fell below 6.5% for the first time in over two weeks.

- The average rate for 15-year fixed mortgages dropped to 5.90%, the lowest since mid-June.

- Market analysts now predict up to three Federal Reserve rate cuts by the end of 2024.

- Mortgage rates are influenced by investor demand for mortgage-backed securities and Federal Reserve policies.

- Homebuyers and those looking to refinance could benefit from lower rates later this year.