Overview

- Moody's downgraded the U.S. credit rating from AAA to AA1, citing decades of fiscal inaction and rising interest costs.

- The national debt has surpassed $36 trillion and is projected to grow by $22 trillion over the next decade without significant policy changes.

- House Republicans advanced a tax-cut bill that could add $3.3 trillion to the debt over 10 years, raising concerns about fiscal sustainability.

- Bond markets reacted sharply, with 30-year Treasury yields spiking above 5%, signaling heightened investor unease.

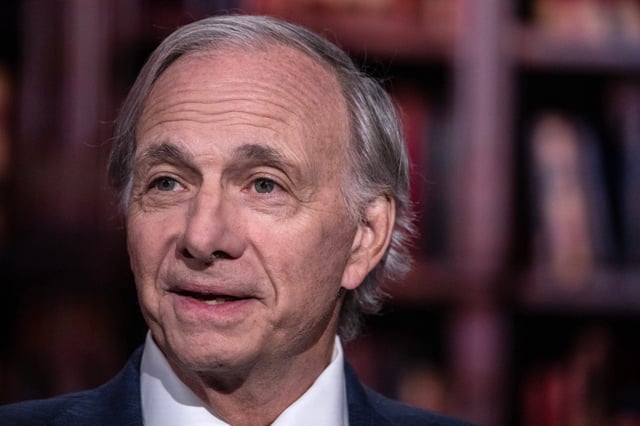

- Economists and experts, including Ray Dalio and Deutsche Bank analysts, warn of systemic risks and potential long-term consequences of fiscal mismanagement.