Overview

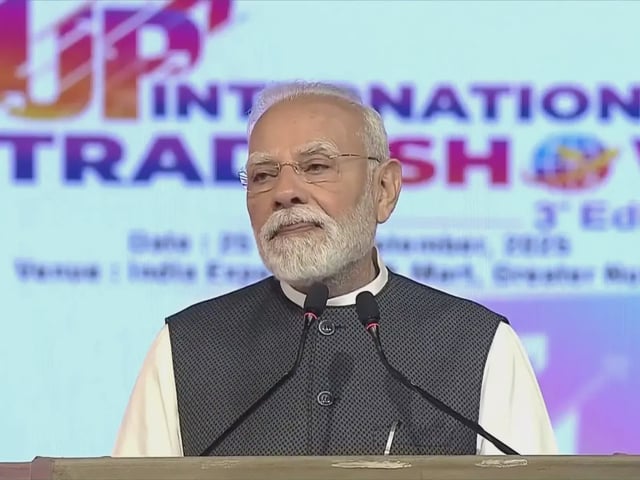

- Speaking at the Uttar Pradesh International Trade Show on September 25, Prime Minister Narendra Modi said GST reforms will continue and the tax burden will keep falling as the economy strengthens.

- Modi illustrated the impact by noting that tax on a ₹1,000 shirt was ₹117 before 2014, fell to ₹50 after 2017’s GST, and is now ₹35 under the Next‑Gen framework that took effect on September 22.

- The government says the combined effect of the new GST and income‑tax relief for those earning up to ₹12 lakh will leave citizens with about ₹2.5 lakh crore in annualised savings.

- The overhaul consolidates most items into 5% and 18% slabs with a limited 40% demerit band, moving many essentials into lower or zero rates to simplify compliance and cut consumer prices.

- State‑level reactions have been swift, with Uttar Pradesh’s chief minister reporting livelier markets and Odisha’s assembly passing a resolution thanking the Centre even as opposition leaders there criticised the timing and benefits.