Overview

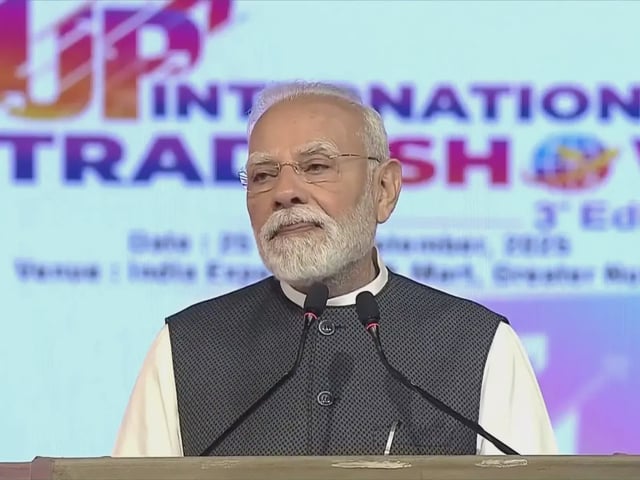

- At the UP International Trade Show, Prime Minister Narendra Modi said GST reforms would continue and highlighted that tax on a ₹1,000 shirt has dropped to ₹35 under the new rates, signalling further easing as the economy strengthens.

- The government projects annualised savings of about ₹2.5 lakh crore from GST 2.0 combined with recent income‑tax relief, with income up to ₹12 lakh currently tax‑free as presented in official messaging.

- RBI’s September bulletin says the streamlined 5% and 18% system—with most essentials at nil or 5%, exemptions for health and life insurance, 33 life‑saving drugs off GST, and a 40% band for sin and luxury—should lower prices, speed refunds and lift consumption.

- Sectoral shifts point to immediate price cuts for compact cars, two‑wheelers and large appliances after moves from 28% to 18%, while premium vehicles and other demerit items move to 40% to balance revenues.

- Trader bodies like CAIT and industry groups such as CII welcomed the overhaul as demand‑boosting, and state leaders launched market outreach and inspections to ensure price pass‑through, with Odisha and Chhattisgarh issuing supportive messages.