Overview

- Moderna reported second-quarter revenue of $142 million and an adjusted loss of $2.13 per share, surpassing analyst expectations of $113 million and a $2.97 per-share loss.

- The company achieved $800 million in cost reductions in the first half of 2025 and announced plans to cut around 10% of its global workforce by year-end.

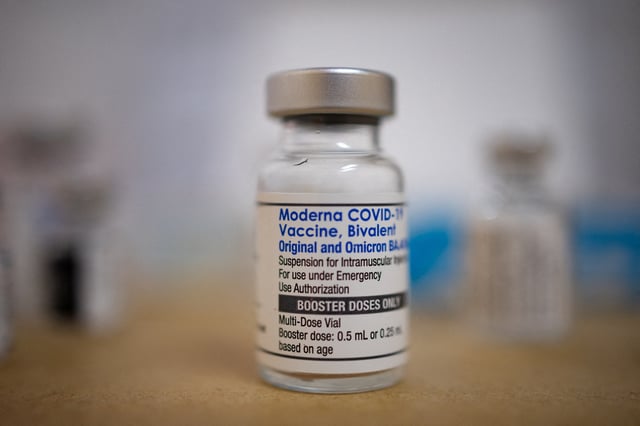

- Full-year revenue guidance was trimmed to between $1.5 billion and $2.2 billion, reducing the top end by $300 million as COVID vaccine demand wanes.

- Spring COVID booster shipments to the United Kingdom have been deferred into the first quarter of 2026 without altering the total contract value.

- Moderna is shifting focus to next-generation mRNA candidates—including an experimental COVID-flu combination shot—to counter declining Spikevax and RSV vaccine sales.