Overview

- Moderna posted $142 million in Q2 revenue and a $2.13 per share adjusted loss, surpassing analyst forecasts of $113 million and a $2.97 loss.

- The company trimmed the high end of its full-year revenue outlook by $300 million to $1.5 billion–$2.2 billion after shifting U.K. spring booster shipments into the first quarter of 2026.

- Operating expenses fell 27% year-over-year to $1.1 billion as Moderna pursues $400 million in additional cost cuts for 2025.

- Moderna plans to reduce its global workforce by about 10%, shrinking headcount to under 5,000 employees by year’s end.

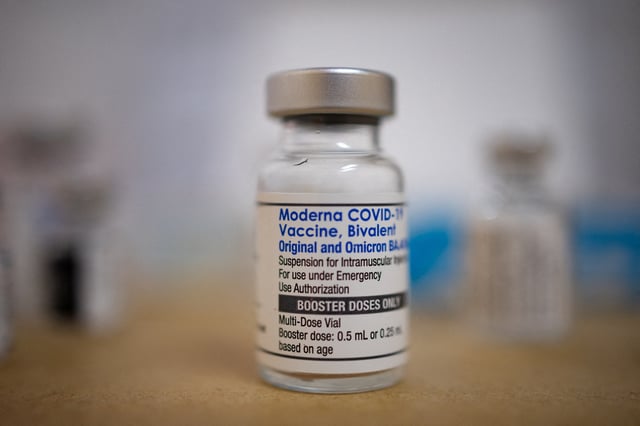

- Its Spikevax COVID-19 booster generated $114 million in sales for the quarter while RSV vaccine mRESVIA delivered negligible uptake.