Overview

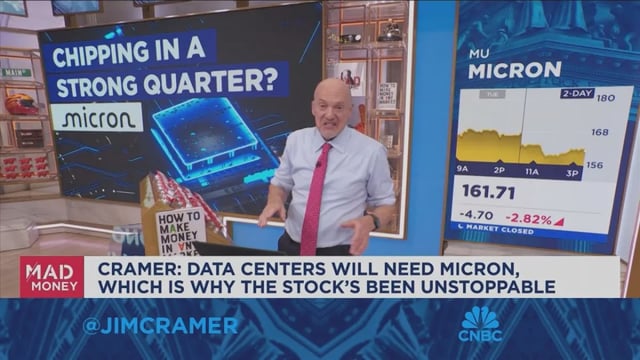

- Fiscal Q4 revenue rose 46% to about $11.3 billion with adjusted EPS of $3.03, beating Wall Street estimates.

- Micron guided Q1 FY2026 revenue to $12.2–$12.8 billion and adjusted EPS to $3.60–$3.90, both above consensus.

- Executives said AI data centers drove the beat, with data-center sales representing roughly 40% of total revenue and HBM a key contributor.

- Shares slipped up to about 3% on the results day as expectations ran high, while Bank of America kept a neutral rating and raised its price target to $180.

- The company spent $13.8 billion on plants and equipment in FY2025 and plans to invest more this year as HBM and NAND supply stay tight, with the stock still reporting large year-to-date gains.