Overview

- Major banks including BBVA, Banamex, Santander and HSBC have published step‑by‑step guides or enabled the MTU control in their apps as the Oct. 1 enablement date approaches.

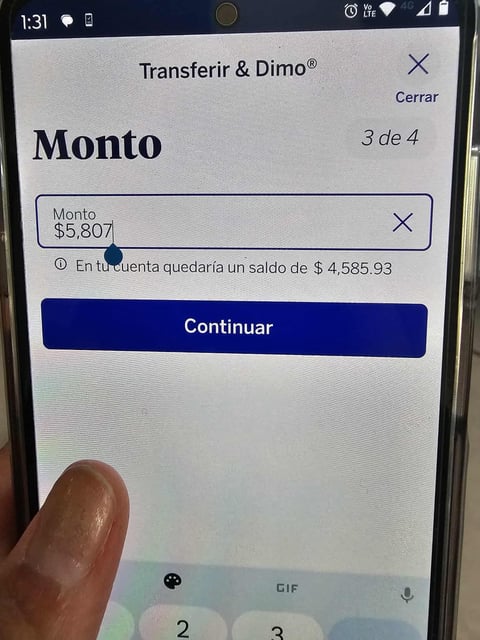

- Users who do not set a personal limit will have an automatic cap of 1,500 UDIS (about 12,800 pesos at current values) per operation, with attempts above that threshold blocked or requiring extra authentication.

- The measure covers digital operations such as SPEI transfers, CoDi/Dimo payments, service payments and card payments to third parties, and it does not impose monetary fines for not configuring the feature.

- The configuration window runs through Sept. 30, the control must be available in apps from Oct. 1, and the regime becomes mandatory in operation on Jan. 1, 2026.

- The requirement applies to institutions operating as banks, and fintechs or sofipos not yet functioning under bank regulation, such as Nu, say the rule does not apply to them for now.