Overview

- Media explain that loans, gifts, and prizes must be reported in the annual return only when, individually or together, they surpass 600,000 pesos in a single fiscal year.

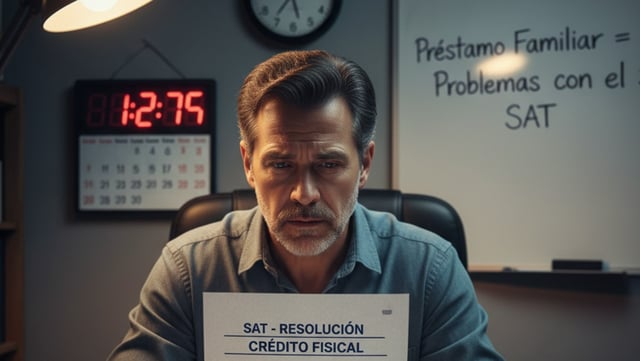

- Small family loans are not illegal and do not trigger penalties on their own, contrary to viral claims circulating this week.

- If the SAT detects a discrepancy, the taxpayer is notified and has 20 days to prove the lawful origin of the funds before the authority assesses ISR with updates and surcharges.

- Articles note that administrative fines can reach about 35,000 pesos per formal breach, with additional proportional penalties that can rise as high as 75% of the undeclared amount.

- Coverage highlights detection through bank and third‑party data and warns that missing paperwork—such as the 86‑A form when funds come from a legal entity—can also lead to sanctions.