Overview

- From October 1, banks must offer MTU settings in their apps, and the regime becomes mandatory on January 1, 2026, when defaults apply if users have not set limits.

- If left unset, institutions will cap transfers at 1,500 UDIS per operation—about 12,800 pesos at the current value—and may require additional authentication for higher amounts.

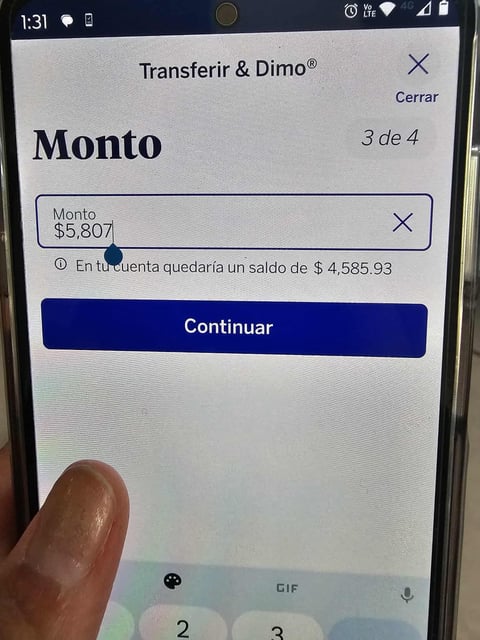

- The measure covers most online operations such as SPEI transfers, CoDi/Dimo payments, and service or card payments, and it does not affect in-person card purchases or cash deposits.

- BBVA, Citibanamex and Santander have activated MTU options and published step‑by‑step guides so customers can define per‑operation, daily, weekly or monthly limits now.

- Nu México said the requirement applies only to entities already operating as banks, so its customers do not need to configure MTU until it begins bank operations.