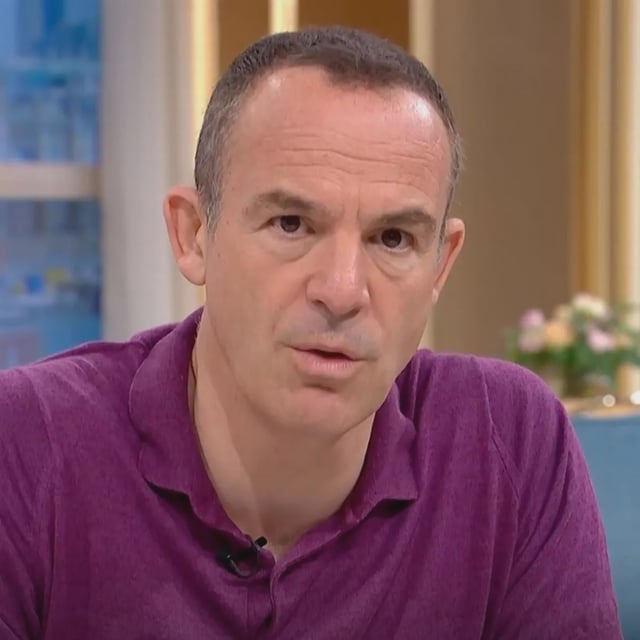

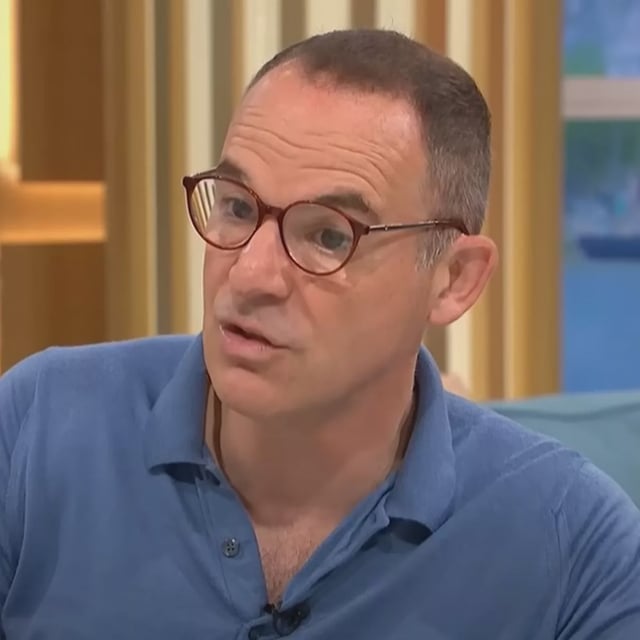

Overview

- Lewis explains that assets left to a spouse are exempt from inheritance tax, a benefit not available to unmarried partners.

- He says unused allowances can be transferred to a surviving spouse, combining the £325,000 nil-rate band with the £175,000 residence band.

- The combined allowances can allow a married couple or civil partners to pass on roughly £1 million tax-free to direct descendants.

- Using a £1 million example, he estimates that an unmarried couple’s heirs could face a £200,000 bill at the 40% rate.

- Lewis recounts a taxi driver who married after 33 years of cohabitation following his advice, underscoring that civil partnerships receive the same tax treatment as marriage.