Overview

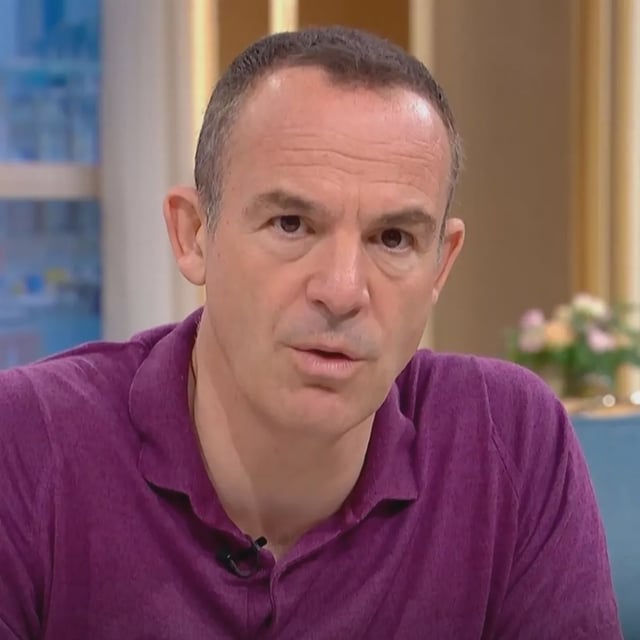

- Martin Lewis used his latest MoneySavingExpert newsletter to urge employees to check payslips now, stressing it is their legal responsibility and that millions of codes are wrong each year.

- Emergency codes such as W1, M1 or X tax each pay period in isolation, meaning many summer or temporary workers may have paid tax despite earning below the £12,570 personal allowance for 2025/26.

- Workers can check their code on their payslip or through the GOV.UK 'Check your Income Tax for the current year' service, which is unavailable if Self Assessment is the only way they pay tax.

- If an emergency code or error is found, HMRC can update the code and refund overpaid tax, with claims typically allowed for up to four years via phone or live chat.

- MSE highlights its Tax Code Checker and guidance, noting examples such as a £9,400 refund, and reminds that 1257L reflects the frozen personal allowance in place since April 2021.