Overview

- The US start-up has a binding agreement to buy Northvolt’s remaining Swedish and German factories, with closing targeted for Q4 2025 subject to approvals.

- Lyten plans to apply for European Union support under frameworks like the Temporary Crisis and Transition Framework, but existing grants won’t transfer automatically.

- New estimates put German taxpayer exposure at around €900 million, up from earlier projections of €600 million for KfW loans and state guarantees.

- The insolvency administrator warns that many creditors will incur substantial losses once the takeover and restructuring proceed.

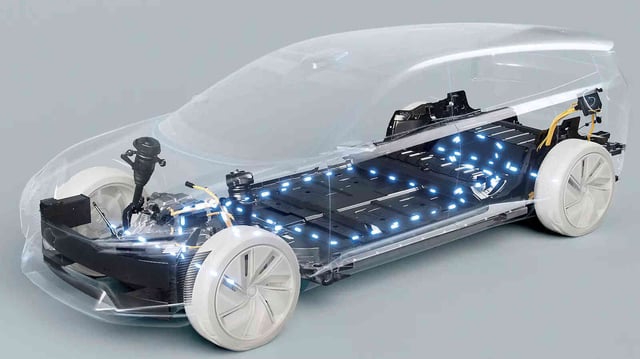

- Lyten, a smaller lithium-sulfur specialist, aims to restart production and expand its workforce pending sign-off from EU, Swedish and German authorities.