Overview

- Deputies passed PL 1,087/2025 by 493–0, sending it to the Senate; if sanctioned this year, the new rules apply from 2026 with effects in 2027 filings.

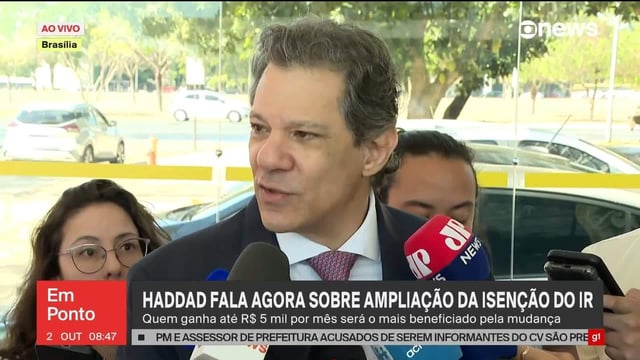

- The measure grants full IR exemption up to R$5,000 per month and a tapering discount from R$5,001 to R$7,350 using the relator’s formula of R$978.62 minus 13.3% of taxable income.

- Fiscal offsets include a progressive minimum tax on annual incomes above R$600,000, reaching 10% from R$1.2 million, plus 10% withholding on dividends above R$50,000 per month and on remittances abroad, with a transition shielding 2025 results distributed by year-end.

- The text creates an automatic mechanism for the federal government to reimburse states and municipalities for any transfer shortfalls caused by the expanded exemption.

- Beneficiary counts vary: the government cites roughly 16 million in 2026 while other reports mention up to 26 million, and cost estimates range from about R$25.8 billion to R$35.9 billion as Arthur Lira shaped the final text and rejected automatic indexing.