Overview

- Bessent formally requested that Congress strike Section 899—dubbed the “revenge tax”—after G7 finance talks secured an exemption for American companies under the OECD’s Pillar 2 framework.

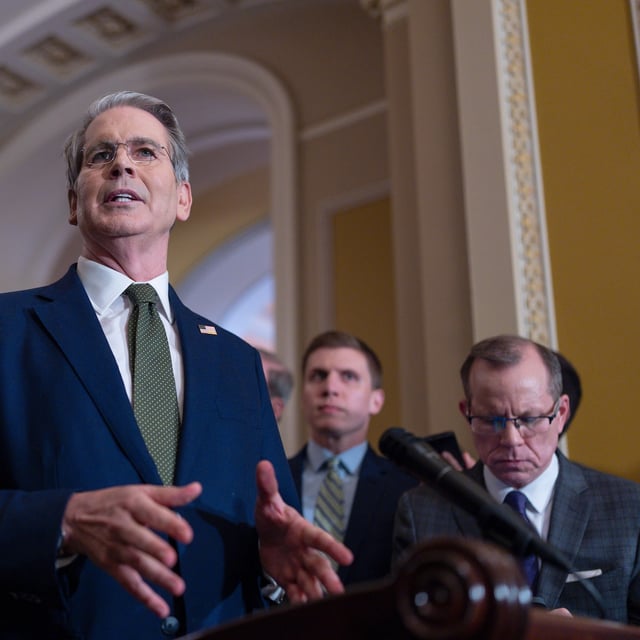

- Senate Finance Chairman Mike Crapo and House Ways and Means Chairman Jason Smith agreed to remove the provision but warned they could reinstate it if other parties slow the implementation of the tax deal.

- Section 899 would have empowered the U.S. to levy punitive withholding taxes on foreign investors from countries deemed to impose “unfair” taxes on American firms.

- The Global Business Alliance estimated that the measure risked costing 360,000 U.S. jobs and $55 billion annually in GDP by deterring international investment and lending.

- Republican leaders now face the challenge of identifying about $52 billion in alternative offsets and overcoming other procedural hurdles before the July 4 reconciliation deadline.