Overview

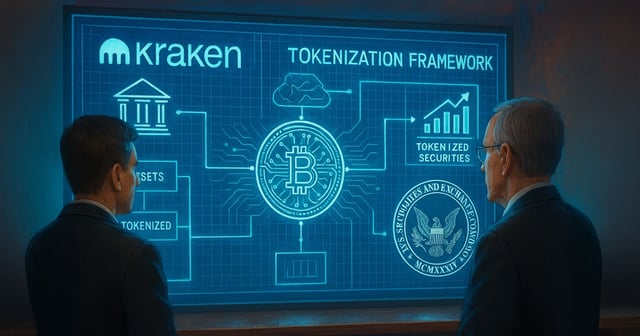

- An internal SEC memo confirms Kraken met the agency’s Crypto Task Force on Aug. 25 to discuss a tokenized trading system under existing U.S. law.

- Kraken’s presentation detailed system architecture, transaction lifecycles, and securities-law obligations while requesting formal guidance for a 24/7 market design.

- The meeting included four Kraken executives and two attorneys from Wilmer Cutler Pickering Hale and Dorr, according to the filing.

- Kraken’s xStocks platform offers tokenized versions of 50+ U.S. equities and ETFs for non-U.S. clients on Solana and BSC, with support for Tron announced last week.

- Global regulators and exchange groups have urged tougher oversight as RWA.xyz estimates about $360 million in tokenized stocks versus roughly $26.5 billion in all tokenized RWAs, and the SEC’s stance remains unresolved.