Overview

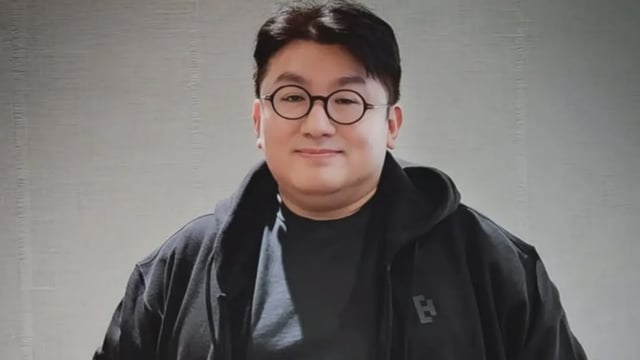

- A Securities and Futures Commission committee voted July 8–9 to refer Bang Si-hyuk and three other HYBE executives for fraudulent securities transactions, with the final decision set for the FSC’s July 16 meeting.

- Regulators accuse Bang of denying IPO plans in early 2020 to persuade shareholders to sell stakes to a private equity fund before Hybe’s October listing.

- Investigators allege a clandestine agreement with the private equity fund yielded Bang roughly 200 billion won (US$145.5 million) in post-IPO profits.

- Authorities suspect the share-transfer arrangement was structured to circumvent post-IPO lock-up restrictions on major shareholders.

- Hybe has apologized for public concern, pledged full cooperation with authorities and maintains its IPO complied with South Korea’s Capital Markets Act.