Overview

- Klarna's Q1 2025 revenues grew 15% to $701 million, but pretax losses doubled year-over-year to $92 million, with credit losses rising 17% to $136 million.

- The company now serves 100 million active customers globally, with growth driven by U.S. expansion and partnerships such as its recent collaboration with DoorDash.

- Consumer debt concerns are mounting, as 41% of BNPL users report struggling to repay loans on time, and a quarter now use these services for essentials like groceries.

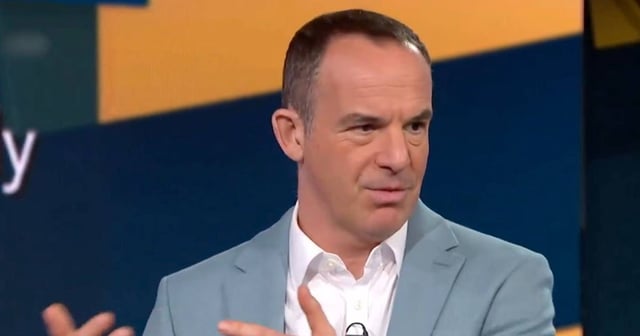

- The U.K. Parliament introduced legislation granting the FCA oversight of BNPL products starting in 2026, prompting warnings from experts like Martin Lewis about potential financial risks.

- Klarna continues to leverage AI to streamline operations, having cut its workforce by 40% since 2022, but is now piloting a gig-based customer service model to complement its AI systems.