Overview

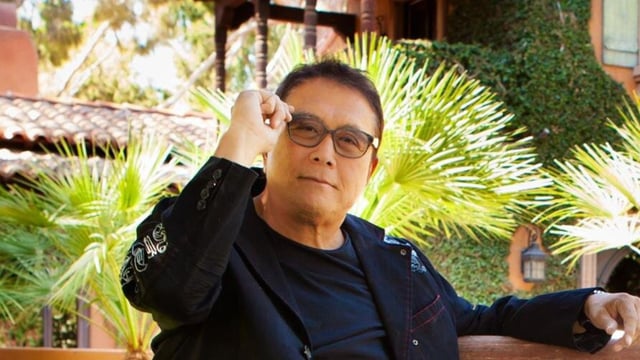

- Robert Kiyosaki urges average investors to use Gold, Silver and Bitcoin ETFs but cautions them to “beware of paper” and counterparty risks.

- He compares ETF claims to a “picture of a gun” and recommends holding physical gold, silver or Bitcoin as real defense in a market crash.

- Kiyosaki warns that an issuer’s insufficient reserves could trigger a confidence crisis and runs on ETFs, risking fund collapse.

- Bloomberg analyst Eric Balchunas stresses that U.S. spot Bitcoin ETFs hold actual Bitcoin on a one-for-one basis and operate under robust regulatory safeguards.

- Spot Bitcoin ETFs approved earlier this year have attracted billions of dollars in daily trades by offering easy access to digital and precious metal assets.