Overview

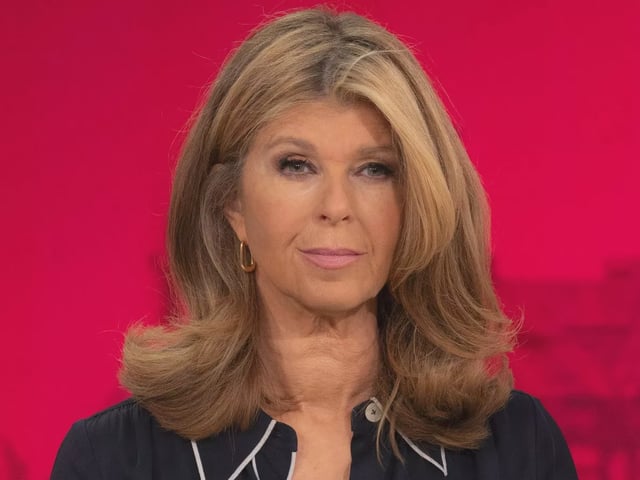

- Kate Garraway faces approximately £800,000 in debts, including a £288,054 tax claim from HMRC, following her late husband Derek Draper's care expenses and company liquidations.

- HMRC's revised tax demand dropped from £716,822 to £288,054, but Garraway disputes the figures and remains in contact with the agency to resolve the matter.

- Garraway has repaid £21,000 so far, but no payouts will be made to creditors due to £32,000 in liquidator fees and limited remaining assets.

- Draper's psychotherapy firm Astra Aspera Ltd, jointly controlled by Garraway, went into liquidation in 2022, owing hundreds of thousands to HMRC and other creditors.

- The financial strain highlights the high costs of long-term care, with Garraway previously paying £16,000 monthly for Draper's care during his four-year battle with long Covid.