Overview

- The tax targets unrealized gains, requiring the wealthy to pay annually based on asset value increases.

- Critics argue the tax could lead to capital flight, reduced investments, and economic instability.

- Supporters believe it will promote fiscal fairness and increase government revenue by $502 billion over a decade.

- The proposal differentiates between tradable and non-tradable assets, complicating its implementation.

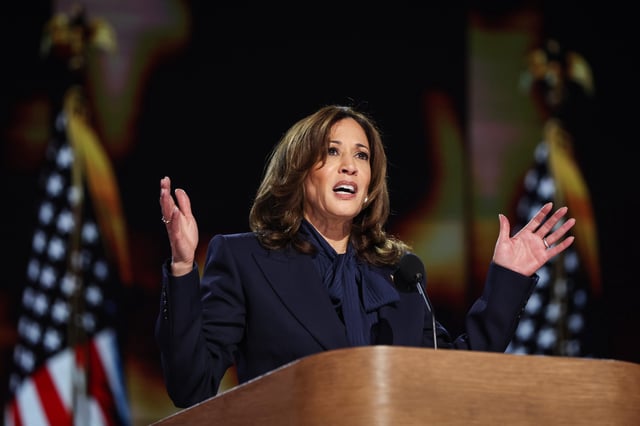

- Harris's endorsement aligns her with Biden's broader tax reform agenda aimed at the ultra-wealthy.