Overview

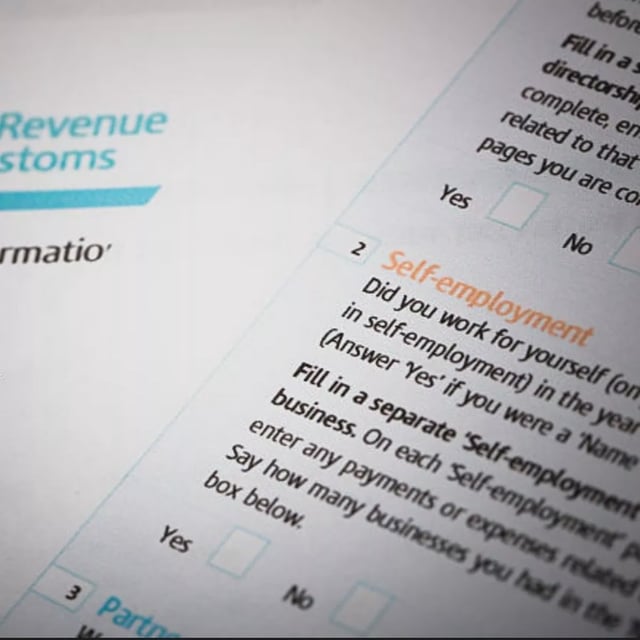

- The second payment on account for the 2024/25 tax year is due by midnight on July 31 for around two million self-assessment filers in the UK.

- Any unpaid balances will incur daily interest at 8.25% from August 1, an initial £100 penalty, £10 per day up to £900, and further 5% or £300 surcharges at six and twelve months.

- HMRC has started issuing 1.4 million Simple Assessment letters outlining unpaid tax on untaxed income and advising recipients to verify their assessments.

- Taxpayers can apply to reduce their July payment using form SA303 or online services, lodge appeals against penalties within 30 days, or set up Time to Pay arrangements.

- Filers whose income has fallen or who have been assigned incorrect tax codes may recover average refunds of around £2,000 by reviewing their assessments and claiming overpayments.