Overview

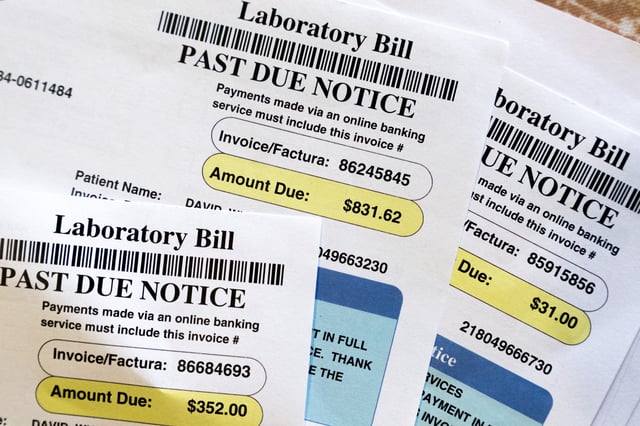

- U.S. District Judge Sean Jordan’s July 11 decision reinstates unpaid medical debt on credit reports for about 15 million Americans.

- The January rule would have excised roughly $49 billion in medical bills and lifted average credit scores by about 20 points, potentially enabling 22,000 additional mortgages per year.

- Jordan found that the Consumer Financial Protection Bureau overstepped its powers under the Fair Credit Reporting Act, siding with lawsuits from credit industry associations.

- CFPB Director Rohit Chopra’s agency has signaled it is unlikely to appeal, leaving consumer relief dependent on new rulemaking or congressional legislation.

- Credit bureaus and lenders praised the ruling for preserving report accuracy, while consumer advocates warn it could drive up borrowing costs for those with medical debt.