Overview

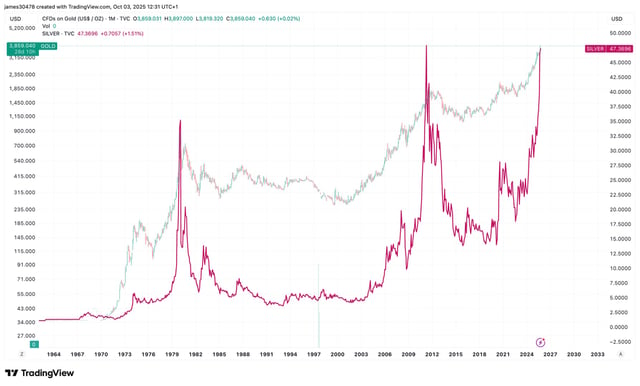

- JPMorgan analysts led by Nikolaos Panigirtzoglou say bitcoin screens undervalued versus gold on a risk-adjusted basis, implying a price near $165,000, roughly 40% above current levels.

- The bank’s framework cites a bitcoin-to-gold volatility ratio below 2.0, meaning BTC consumes about 1.85 times more risk capital than gold and would need about a 42% market-cap lift to match roughly $6 trillion in private gold holdings.

- JPMorgan frames the $165,000 level as a mechanical parity exercise rather than a formal price prediction.

- Spot bitcoin ETFs logged several large inflow days this week — about $675.8 million on Oct. 1 and roughly $627 million on Oct. 2 — as BTC traded around $119,000 to $121,000.

- ETF flows appear retail-led while many institutions favor CME futures, and Citi separately set a $181,000 12‑month base case for BTC, highlighting broader bullish recalibrations across Wall Street.