Overview

- Argentina was removed from the EMBI+ in J.P. Morgan’s late‑September rebalance and shifted into the EMBI Global Diversified index.

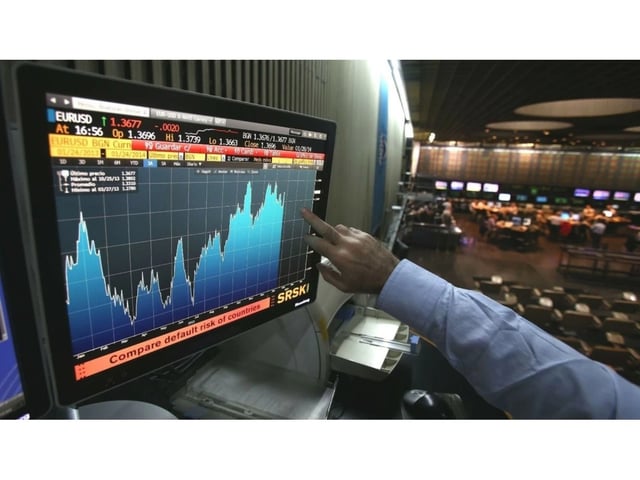

- Minute‑by‑minute risk‑premium updates have ceased, with a single daily reading replacing them; LSEG confirmed the EMBI+ Argentina realtime feed stopped on September 30.

- Market sources cite EMBI+ methodology requiring sovereign dollar bonds issued within the past five years, a condition no longer met after Argentina’s 2020 issuance.

- J.P. Morgan told El Cronista the change is a technical subindex adjustment that does not revise its sovereign risk view, and Argentina holds a 2.1% weight in EMBIGD.

- The move reduces real‑time visibility and liquidity signaling for Argentine debt as officials hold meetings in Washington with U.S. Treasury and IMF counterparts.