Overview

- J.P. Morgan executed the change in a late‑September rebalance after Argentina’s 2020 bonds aged beyond the EMBI+ five‑year inclusion window.

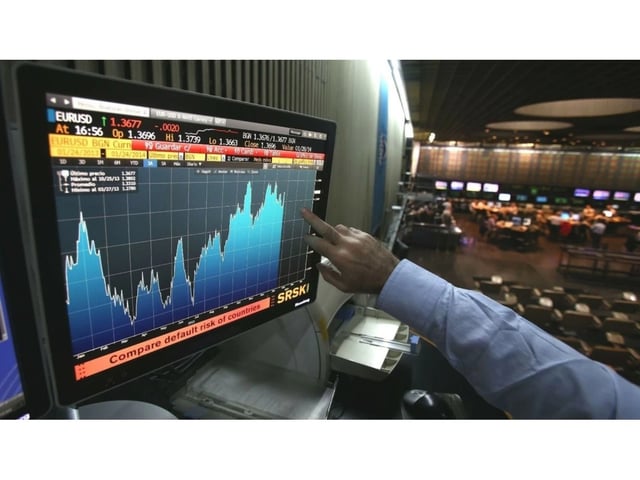

- LSEG confirmed the "Argentina EMBI+ Realtime JPM" feed ceased after September 30, ending minute‑by‑minute country‑risk updates.

- Argentina remains in the EMBI Global Diversified benchmark with an estimated 2.1% weight, which the bank says is unchanged.

- The risk premium for Argentina will now be reported once per day at the close, reducing intraday visibility for investors and traders.

- J.P. Morgan characterized the move as a technical methodology outcome, while market commentary links it to the absence of new hard‑currency issuance since 2020 and related liquidity constraints.