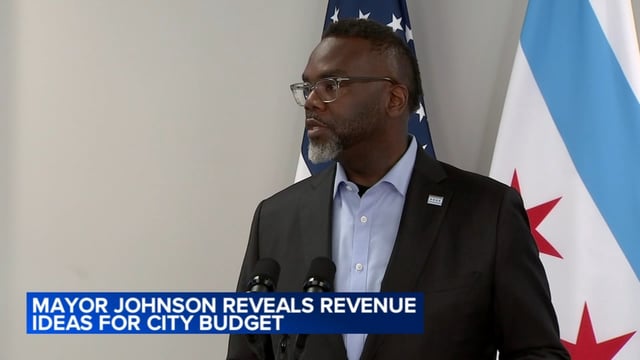

Overview

- City Council refusals of homeowner tax hikes have contributed to a projected $1 billion-plus deficit for 2026, prompting fresh revenue proposals.

- Johnson’s plan revives the $4-per-employee corporate head tax that was in place from 1973 to 2014 to tap large employers.

- He is advancing a digital advertising levy on tech platforms and weighing a corporate income tax that would require state approval.

- Officials are pursuing voluntary payment-in-lieu-of-tax agreements with wealthy universities and hospitals to bolster city coffers.

- Progressive allies such as the Chicago Teachers Union support the measures, while business groups caution they could hinder hiring and investment.