Overview

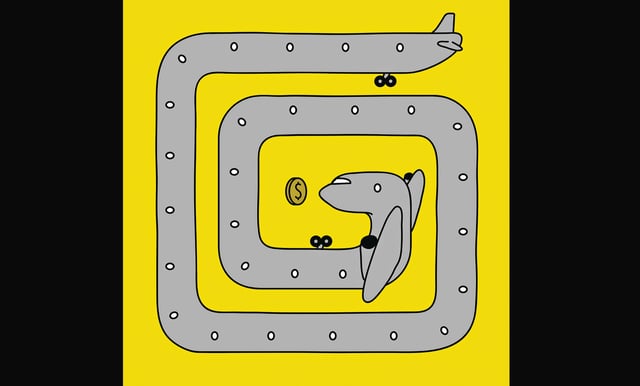

- JetBlue Airways is seeking court approval to acquire Spirit Airlines for $3.8 billion, a move that the Justice Department argues will raise fares and reduce competition.

- The acquisition would increase JetBlue's market share to over 10%, placing it behind United, the smallest of the big four airlines, which controls 16% of the market.

- The Justice Department argues that the merger would reduce competition, especially on the 262 routes where the airlines compete, and could increase JetBlue's market share on more than a dozen routes to over 50%.

- JetBlue argues that the merger will provide the scale to become a viable, disruptive fifth national challenger to the industry's dominant airlines.

- The outcome of the trial could reshape the field of ultra-low-cost airlines, with Frontier becoming the biggest discount carrier in the U.S. if Spirit is acquired by JetBlue.