Overview

- The US imposed two 25% tariffs on Indian imports on July 30 and August 6 in response to New Delhi’s purchases of Russian military equipment and crude oil.

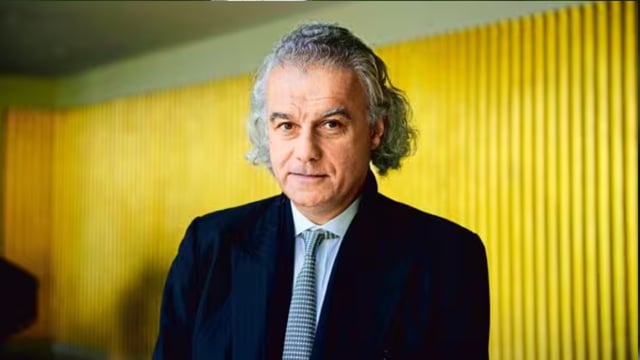

- Jefferies strategist Christopher Wood retains a marginal overweight stance on India and advises buying on market dips.

- India’s benchmark NSE Nifty 50 has fallen about 0.9% and the rupee slipped 0.16% against the dollar since the initial tariff announcement.

- Indian authorities and exporters are preparing sector relief measures and contingency plans to mitigate the duties’ impact.

- Wood warns the US pressure is strengthening BRICS coordination and could accelerate shifts toward de-dollarisation.