Overview

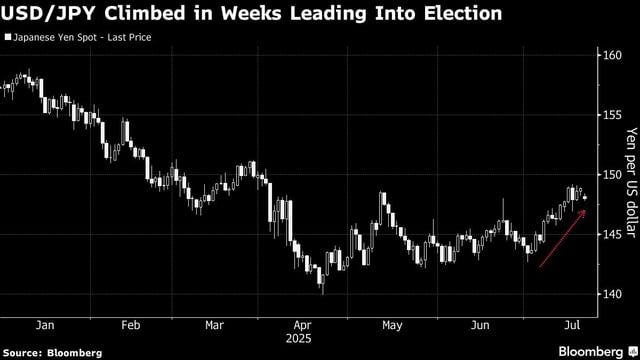

- The July 20 upper-house election undermined Prime Minister Shigeru Ishiba’s coalition and increased the likelihood of tax cuts and larger fiscal deficits.

- Thirty-year JGB yields have climbed but remain near 3%, a level low by historical standards given Japan’s debt burden.

- The Bank of Japan’s yield curve control framework and near-zero short-term rates continue to anchor bond market stability.

- A weak yen and Japan’s return to sustained inflation bolster investor demand alongside massive domestic savings.

- Foreign investors have poured over ¥15 trillion into Japanese bonds this year to capture attractive swap-adjusted returns.