Overview

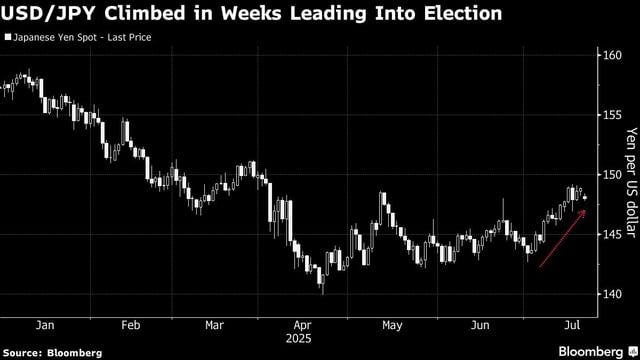

- The July 20 upper house vote cut into Prime Minister Ishiba’s coalition and raised expectations of tax cuts financed by larger deficits.

- Thirty-year yields have climbed about 80 basis points this year to roughly 3%, yet they remain lower than what Japan’s $8 trillion debt would normally command.

- Foreign investors have poured over ¥15 trillion into JGBs so far in 2025, enticed by swap-adjusted spreads against U.S. Treasuries.

- Structural factors including a weak yen, legacy ultra-low rates, Tokyo’s net creditor status with $3.6 trillion invested overseas and BOJ support are keeping yields contained.

- Analysts such as Capital Economics’ Marcel Thieliant expect ten-year yields to approach 2% by late 2026 if monetary policy veers hawkish.