Overview

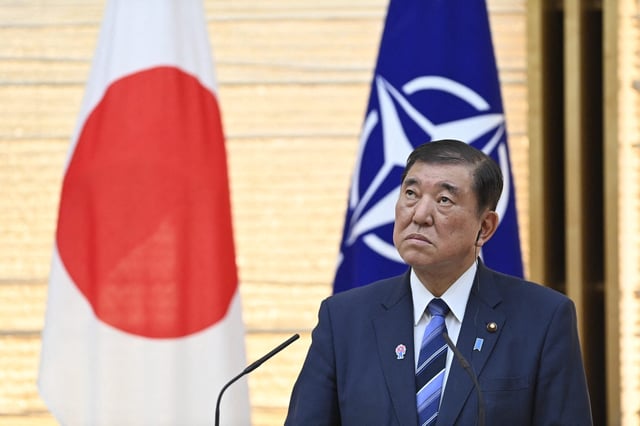

- Finance Minister Katsunobu Kato stated Japan's $1 trillion-plus US Treasury holdings could be considered as leverage in trade negotiations with the United States.

- Kato emphasized that the primary purpose of these holdings is to maintain liquidity for yen interventions but acknowledged they might serve as a negotiation tool.

- This marks a departure from Kato's earlier position, where he ruled out using Treasury holdings in trade discussions.

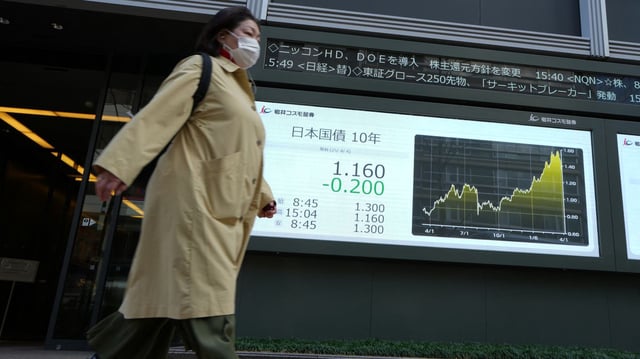

- The global sell-off in US Treasuries following President Trump's April tariffs has heightened focus on Japan's and China's significant debt holdings.

- The next round of US-Japan trade and economic security talks is scheduled for mid-May, with Treasury holdings likely to remain a key discussion point.