Overview

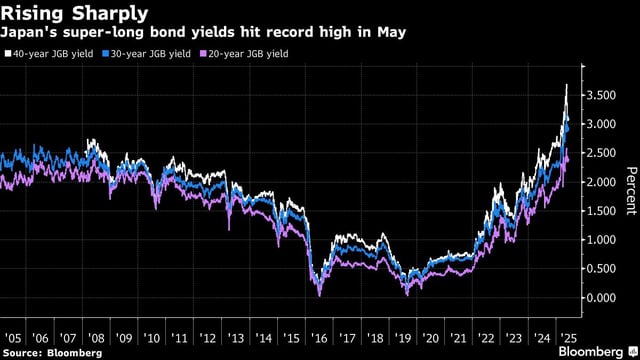

- The finance ministry will reduce 20-year JGB sales by ¥1.8 trillion to ¥10.2 trillion and cut 30- and 40-year offerings by ¥900 billion and ¥500 billion respectively through March 2026.

- Total planned JGB issuance for the fiscal year will fall by ¥500 billion to ¥171.8 trillion as increased shorter-term note sales partly offset super-long reductions.

- Starting next month, 20-year JGB auctions will see a ¥200 billion cut per sale, doubling the reduction from the draft plan.

- The Bank of Japan will slow its tapering of bond purchases from the next fiscal year to support market stability alongside issuance cuts.

- Officials have ruled out immediate buybacks of older super-long JGBs but have left the option open pending further discussions on feasibility and funding.