Overview

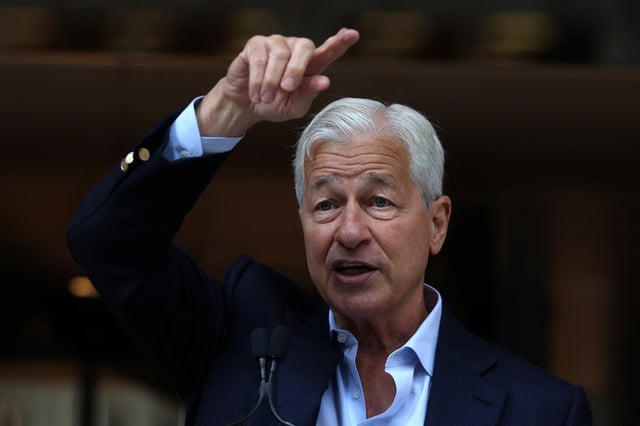

- The JPMorgan CEO told the BBC he is more worried than most about a significant U.S. market decline, estimating roughly a 30% probability versus what he says markets price at about 10%, within a six‑month to two‑year window.

- He cautioned that although artificial intelligence will deliver broad benefits, some AI investments will probably be lost, echoing recent alerts from the Bank of England and the IMF about stretched valuations and rising uncertainty.

- Dimon reiterated that a U.S. recession remains possible in 2026 and said he is a little more nervous that inflation may not fall as expected, despite 3.8% Q2 GDP growth, soft monthly job gains, and prices running near 3% year over year.

- He cited elevated risks from geopolitics, heavy fiscal spending, and global remilitarization, and suggested the United States has become a little less reliable as a partner.

- Dimon called the ongoing government shutdown a bad idea that is not helping the economy as key data are delayed, while emphasizing JPMorgan’s readiness through rigorous stress testing.