Overview

- A technical commission’s draft urges cancelling about €408 billion of unrecoverable tax credits, roughly 32% of a residual stock of around €1.27–€1.30 trillion.

- The plan targets legally non-collectible debts and roles with remote recovery prospects, with most losses falling on the Erario and smaller shares on INPS and local entities.

- The same report recommends letting the collection agency see current bank-account balances and use e-invoicing data to focus seizures, but Finance Minister Giancarlo Giorgetti said this will remain only a proposal.

- Suggested timelines set discarico of roles from 2000–2010 by 31 December 2025, 2011–2017 by end-2027, and 2018–2024 by end-2031, alongside calls for more staff and interoperable data.

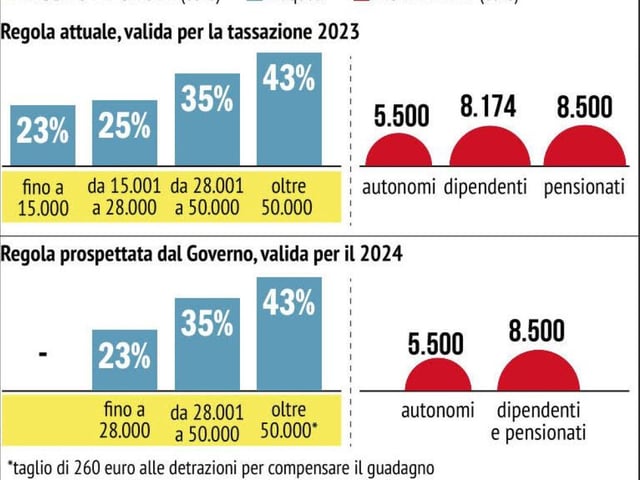

- The government is studying a cut of the 35% Irpef bracket to 33% for incomes €28k–€50k, possibly up to €60k, with estimated costs of about €4–€8 billion and parallel work on family-based detraction reforms while the Lega pushes a new long rottamazione.