Overview

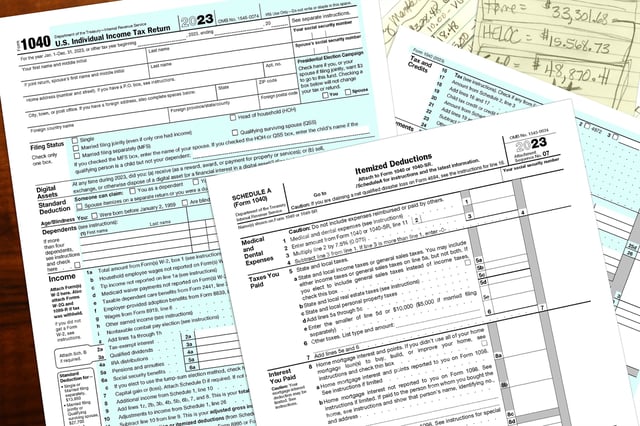

- Over $1 billion in unclaimed 2020 tax refunds are available, with a deadline to claim by May 17, 2024.

- State tax credits offer additional opportunities for savings, with credits varying by state.

- IRS emphasizes the importance of filing 2020 returns to claim refunds, especially for those affected by the pandemic.

- Low- and moderate-income workers may be eligible for significant credits, such as the Earned Income Tax Credit.

- Free tax preparation and filing services are available to help taxpayers claim their refunds.