Overview

- The IRS reports $1 billion in unclaimed tax refunds for 2021, affecting approximately 1.1 million Americans nationwide.

- Taxpayers must file their 2021 federal income tax returns by April 15, 2025, to claim refunds or risk forfeiting the money to the U.S. Treasury.

- The median refund amount for 2021 is estimated at $781, with some taxpayers eligible for additional credits like the Earned Income Tax Credit, worth up to $6,728 for qualifying individuals with children.

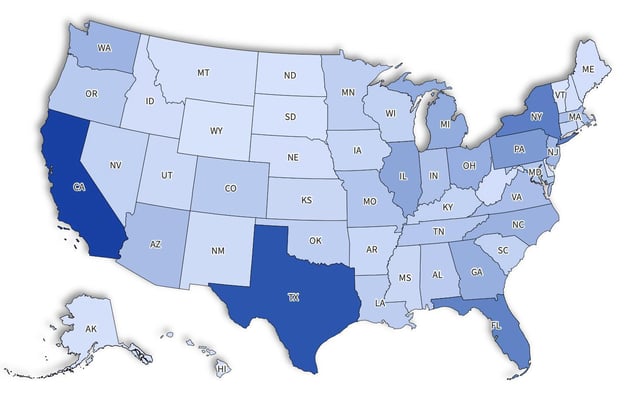

- Key states with the most unclaimed refunds include California, Texas, and New York, where tens of thousands have yet to file their returns.

- The IRS advises taxpayers to gather necessary documents, such as W-2s and 1099s, and offers free filing assistance for low- to moderate-income individuals through programs like VITA.